These products have rapid growth and dominant market share. In a mature industry, it is advisable for a company to keep the sales volume high as the business unit is comparatively a good source to generate revenue. This is how the organization is earning a significant amount of revenues from its finished products. The bottling partners in different regions help in making the finished beverages available to the market.

This product is sold across 200 countries in a mature beverage industry. However, when Cash Cows lose their appeal and move towards decline, a retrenchment policy may be followed.Ĭoca-Cola is one such example of Cash Cows. Further, these firms required little investment and generate cash that can be utilized for investment in other business units. Businesses under this category usually follow stability strategies. Cash Cows (Low Growth, High Market Share)Ĭash Cows category represents businesses having a large market share in a mature, slow-growing industry. However, in some areas, it has been able to obtain a generous sales volume. Therefore, the brand is losing its popularity. As the brand has not been able to gain widespread popularity similar to Coke.

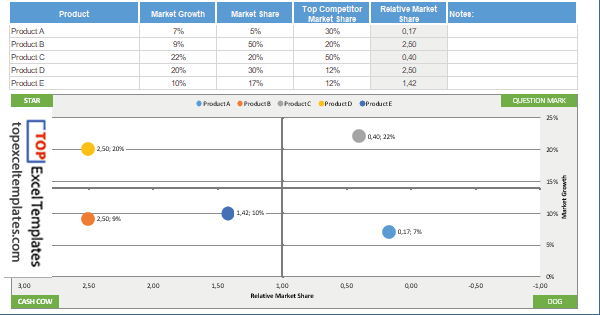

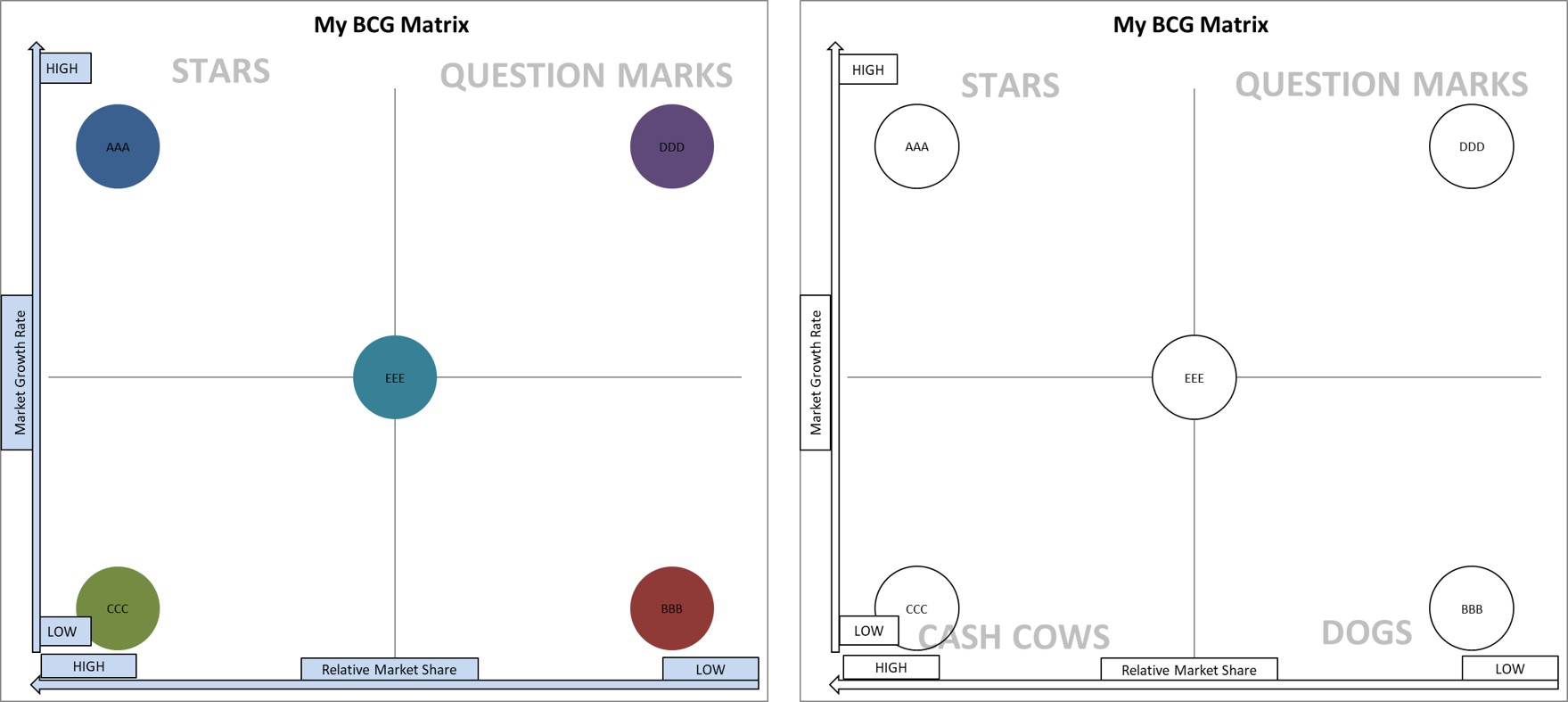

No doubt the market has growth opportunities, but these products have not succeeded to take benefits of these market opportunities to such an extent that they can be recognized as Stars.įanta, a Coca-Cola product, is one such example where the business units can be seen as a question mark. Therefore, they require a huge amount of investment to gain or maintain market share and to become a Star product. Generally, these products are the startup or new products, which have a good commercial prospect. As the name suggests, it is difficult to say if these products will become the Stars or drop into the Dogs category. These businesses represent a low market share in a high growth industry. Let’s understand BCG Matrix in detail with examples: Question Marks (High Growth, Low Market Share) The four categories are explained below with BCG Matrix diagram: The categories were all given remarkable names- Cash Cows, Stars, Dogs, and Question Marks. BCG Model puts each of a firm’s businesses into one of four categories.

DefinitionīCG Matrix helps business to analyze growth opportunities by reviewing the market growth and market share of products and further help in deciding where to invest, to discontinue or develop products. Therefore, The Boston Consulting Group designed product portfolio matrix (BCG matrix) or growth-share matrix to help business with long-term strategic planning. Every business needs strategic planning to rule in the industry.

0 kommentar(er)

0 kommentar(er)